“Nothing is more portable than rich people and their money”

Attributed without source

Money: Whence It Came, Where It Went (1975)

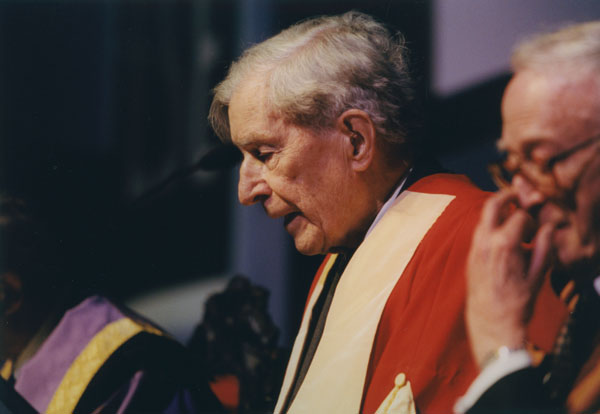

John Kenneth Galbraith, né le 15 octobre 1908 à Iona Station , en Ontario , et mort le 29 avril 2006 à Cambridge , est un économiste américano-canadien. Il a été le conseiller économique de différents présidents des États-Unis : Franklin Delano Roosevelt, John Fitzgerald Kennedy et Lyndon B. Johnson. Wikipedia

“Nothing is more portable than rich people and their money”

Attributed without source

Money: Whence It Came, Where It Went (1975)

Chapter VIII https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929, Aftermath II, Section I, p 144

The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929)

Source: The Affluent Society (1958), Chapter 1, Section I, p. 13

Source: The New Industrial State (1967), Chapter I, Section 3, p. 6

Source: Money: Whence It Came, Where It Went (1975), Chapter IX, The Price, p. 106

Source: The New Industrial State (1967), Chapter XXVIII, Section 3, p. 321

As quoted in Adolf Hitler: The Definitive Biography (1991), by John Toland, also quoted in "Repatriation — The Dark Side of World War II (1995) by Jacob G. Hornberger http://www.fff.org/freedom/0795a.asp

Source: The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929), Chapter V, The Twilight of Illusion, Section I, p. 68

“The enemy of the conventional wisdom is not ideas but the march of events.”

Source: The Affluent Society (1958), Chapter 2, Section IV, p. 21

“The privileged have regularly invited their own destruction with their greed.”

Source: The Age of Uncertainty (1977), Chapter 10, p. 293

“The process by which banks create money is so simple that the mind is repelled.”

Source: Money: Whence It Came, Where It Went (1975), Chapter III, Banks, p. 18

Source: The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929), Chapter VI, The Crash, p. 104

Source: The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929), Chapter I, A Year To Remember, p. 4

The Ashes of Capitalism and the Ashes of Communism (1986)

“You roll back the stones, and you find slithering things. That is the world of Richard Nixon.”

Speech of Adlai Stevenson, Los Angeles (1956), written by Galbraith

Source: The New Industrial State (1967), Chapter XXII, Section 4, p. 255

Source: The New Industrial State (1967), Chapter V, Section 2, p. 49

Source: The New Industrial State (1967), Chapter VI, Section 2, p. 62

Chapter VI https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929, Things Become More Serious, Section II, p 110

The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929)

Source: The Age of Uncertainty (1977), Chapter 1, p. 22

Source: The Great Crash, 1929 (1954 and 1997 https://openlibrary.org/books/OL25728842M/The_Great_Crash_1929), Chapter VIII, Aftermath I, Section III, p. 141

Source: The New Industrial State (1967), Chapter XX, Section 1, p. 219 (Caps as per text...)

“Only in very recent times has the average man been a source of savings.”

Source: The New Industrial State (1967), Chapter IV, Section 2, p. 37

“Men are, in fact, either sustained by organization or they sustain organization.”

Source: The New Industrial State (1967), Chapter VIII, Section 5, p. 96

“There is something wonderful in seeing a wrong-headed majority assailed by truth.”

The Guardian [UK] (28 July 1989)

The Ashes of Capitalism and the Ashes of Communism (1986)

“We do not manufacture wants for goods we do not produce.”

Source: The Affluent Society (1958), Chapter 9, Section VI, p. 113

Source: The Affluent Society (1958), Chapter 18, Section I, p. 199

The New York Times Magazine (9 October 1960)