178-9

Value and capital, (1939)

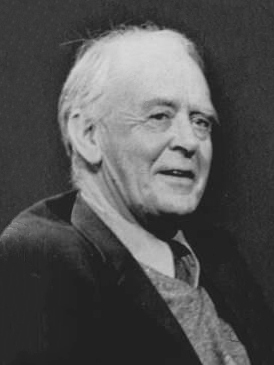

John Hicks: Citations en anglais

Source: Money, Interest and Wages, (1982), p. 6

Contexte: I remember Robbins asking me if I could turn the Hayek model into mathematics... it began to dawn on me that... the model must be better specified. It was claimed that, if there were no monetary disturbance, the system would remain in 'equilibrium'. What could such an equilibrium mean? This, as it turned out, was a very deep question; I could do no more, in 1932, than make a start at answering it. I began by looking at what had been said by... Pareto and Wicksell. Their equilibrium was a static equilibrium, in which neither prices nor outputs were changing... That, clearly, would not do for Hayek. His 'equilibrium' must be progressive equilibrium, in which real wages, in particular, would be rising, so relative prices could not remain unchange … The next step in my thinking, was … equilibrium with perfect foresight. Investment of capital, to yield its fruit in the future, must be based on expectations, of opportunities in the future. When I put this to Hayek, he told me that this was indeed the direction in which he had been thinking. Hayek gave me a copy of a paper on 'intertemporal equilibrium', which he had written some years before his arrival in London; the conditions for a perfect foresight equilibrium were there set out in a very sophisticated manner.

John Hicks, The Theory of Wages, 2nd Edition (1963), p. 307

Source: Value and capital, (1939), p. 184 as cited in: Asheim, Geir B. "Economic analysis of sustainability." Justifying, Characterizing and Indicating Sustainability (2007): 1-15.

Source: Value and capital, (1939), p. 172

Source: Money, Interest and Wages, (1982), p. 28; on his "Equilibrium and the Cycle" (1933), an influential work on the topics of intertemporal equilibrium, monetary theory, and trade cycle phenomena.

“I did not begin from Keynes: I began from Pareto, and Hayek.”

Source: Classics and Moderns, (1983), p. 359 : footnote 10: There is evidence for this, in the paper 'Equilibrium and the Cycle'

Source: Classics and Moderns, (1983), p. 97

Source: Value and capital, (1939), p. 271–2; as cited in: Roberto Scazzieri, Amartya Sen, Stefano Zamagni (2008) Markets, Money and Capital: Hicksian Economics for the Twenty First Century, p. 161

Kenneth Arrow and John Hicks (1972) From Nobel Lectures, Economics 1969-1980, Editor Assar Lindbeck, World Scientific Publishing Co., Singapore, 1992 ( online http://www.nobelprize.org/nobel_prizes/economics/laureates/1972/presentation-speech.html)

Source: Classics and Moderns, (1983), p. 359

Source: Money, Interest and Wages, (1982), p. 340

John Hicks (1979), quoted in: Nitasha Kaul (2007) Imagining Economics Otherwise. p. 76